Following the money: business students explore careers as IRS special agents

Following the money: business students explore careers as IRS special agents

When other law enforcement failed to arrest and convict notorious 1930s gangster Al Capone, U.S. Treasury agents stepped in.

Because all income, even income from unlawful sources, is taxable, Internal Revenue Service criminal investigators followed a money trail left by the infamous mobster and their work led to his capture, conviction and incarceration.

This fall, several dozen Rowan University business students learned from IRS investigators that they can apply their skills and lessons to pursue criminals too.

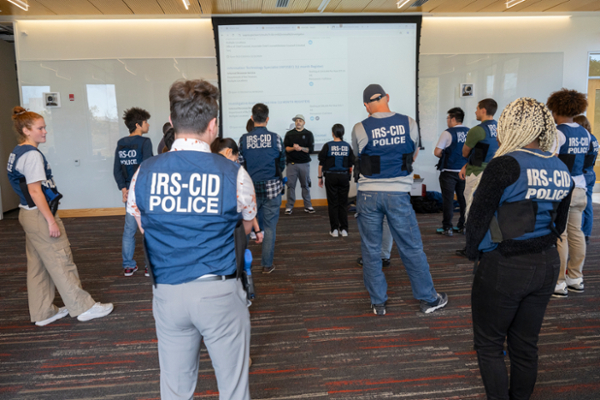

A daylong program in the Rohrer College of Business Nov. 1 featured investigators from New Jersey’s Newark Office of the IRS who “deputized” about 25 students and walked them through a scenario of how aspiring accountants like themselves can follow a different career path than one they might have considered – into law enforcement.

The program, led by Special Agent and Public Information Officer Robert Glantz, started with a brief by an “informant” who talked about his work with a potential terror ring, providing students the kind of lead that law enforcement follows every day.

IRS Criminal Investigation (IRS CI) is involved with terrorism, Glantz said, because financing is always involved in terror plots.

Wearing the uniform of specialized law enforcement – blue police windbreakers, handcuffs and sidearms – agents swore students in, walked them through the details of the investigation, fitted them with vests and mock weapons, and taught them the basics in making an arrest.

“We do three types of investigation,” Glantz said, “legal source, illegal source, and narcotics and terrorist financing.”

Noting that the “bread and butter” of IRS criminal investigators’ work is into legal income streams on which taxes aren’t paid, Glantz told students that simply “following the money” leads to a wide range of crimes, from white collar to terrorist financing.

“We investigate allegations of tax fraud but there are many, many things you can do in IRS Criminal Investigations,” he said. “And I guarantee you will have a blast doing it.”

Great pay and benefits

Glantz said starting pay for IRS CIs in northern New Jersey is around $80,000, tops out around $200K, and the position includes full benefits and a pension.

Alumnus Andrew Van Hook, now a senior lecturer and assistant department chair in Accounting and Finance, said though students often aspire to positions with “big four” accounting firms, the RCB hosted the IRS program so students know about options they might not have considered before graduating.

While accounting, auditing and tax preparation have always formed the bedrock of great careers, Van Hook said, “we teach them that there are many options based on what they learn here.

“When we teach auditing, we teach that they must be skeptical, so they examine things,” he said. “It’s amazing what you can find by following the money if you know what to look for.”

The program, officially known as the IRS Citizens Academy, was held to help students sharpen forensic accounting skills, learn about interviewing suspects, and conduct surveillance and document analysis.

Alumna Avra Kirsch, a 2003 Law & Justice graduate who earned her MBA before joining the IRS CI unit, works on the FBI Joint Terrorism Task Force, an assignment that pairs her with officers from virtually every other federal law enforcement agency.

“All I can tell you is, we are busy,” Kirsch said. “We investigate international and domestic terrorism and there’s always something going on.”

Senior Accounting & Finance major Lauren McDevitt said though she aspires to a more traditional career, at least upon graduation, the program piqued her interest.

“For now, I’m looking at public accounting, but down the road you never know,” she said.

For information about upcoming job fairs for IRS special agent positions, visit the IRS Careers page.