Connor Shields decided his future while sitting in the Majestic Theater on Broadway. Sitting between classmates during a high school choir trip, the o...

Rowan Today

News

April 23, 2024

When Keri Cronin received a devastating cancer diagnosis during medical school, she didn’t know if she’d survive, much less finish her studies at Cooper Medical School of Rowan University.

April 23, 2024

Elementary teaching, a field that’s still predominately female, is Michael Stanton's calling.

April 22, 2024

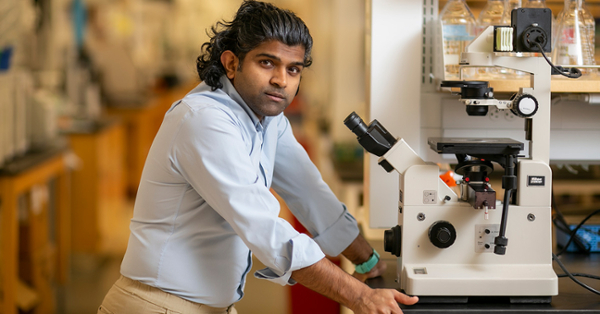

Goutham Kodakandla was already an experienced researcher when he spotted a social media post about an opportunity to join Rowan University's Ph.D. program in molecular cell biology and neuroscience.

April 22, 2024

For Katerina Kasatkin, it's all about the outcome, "working hard little by little every single day, practicing, practicing and achieving a final result," The biomedical engineering major is heading to medical school after graduation.

April 22, 2024

Psychological science major Sophie Ogunsanmi is heading to a Ph.D. in neuroscience program, where she plans to study the neural effects of traumatic stress. Her research interest was partly shaped by the pandemic's forced social isolation. “We are not created to walk this life alone,” she said.

April 22, 2024

When it came to capitalizing on every experience available to her at Rowan University, Anushree Chauhan checked every box.

April 22, 2024

Leslie Canales Franco wants to turn the nutrition field upside down.

April 22, 2024

Naval doctor strives to empower women and aid service members\r\nOluwapelumi Oluwo, a 28-year-old from Dumfries, VA, applied to the Navy and medical s...

April 22, 2024

Brendan Bermingham has a special mindset: Set sights on goal. Get it done. Repeat.