Mark Clouse is the latest CEO to take part in on-going series in the Rohrer College of Business.

Rowan Today

News

April 18, 2024

The U.S. Army Engineer Research and Development Center (ERDC) and Rowan University have formally established an education partnership, significantly expanding the University’s yearslong collaboration with the center’s engineers and scientists.

April 17, 2024

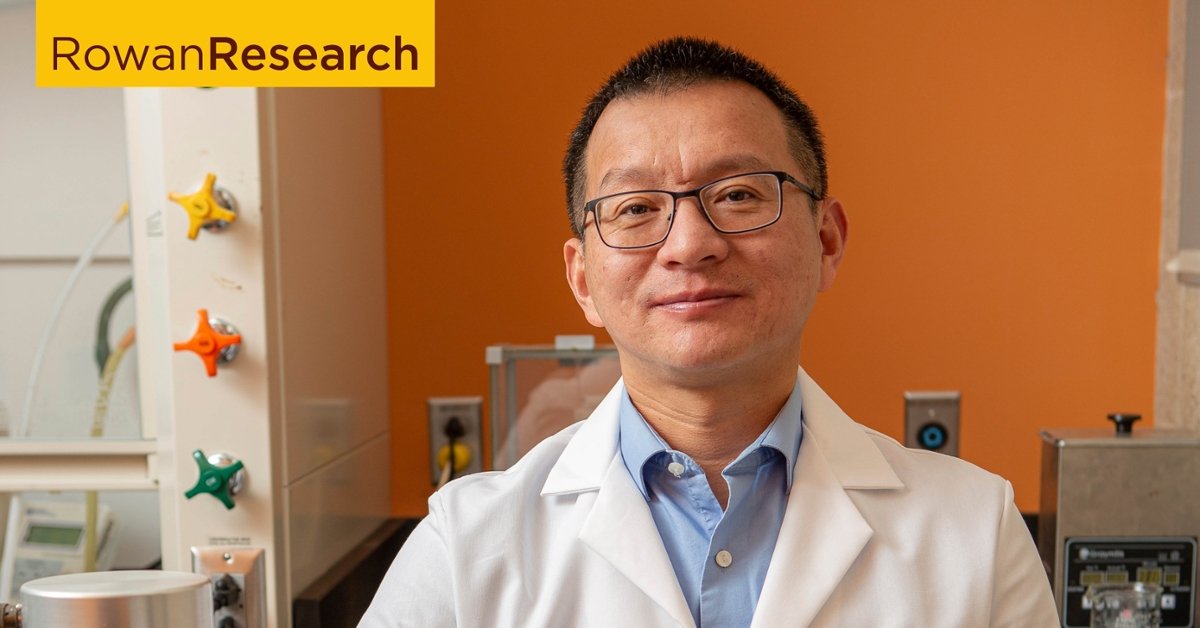

Functional materials can be used to build advanced structures such as wearable sensors and electronics. Meet Wei Xue, mechanical engineer.

April 17, 2024

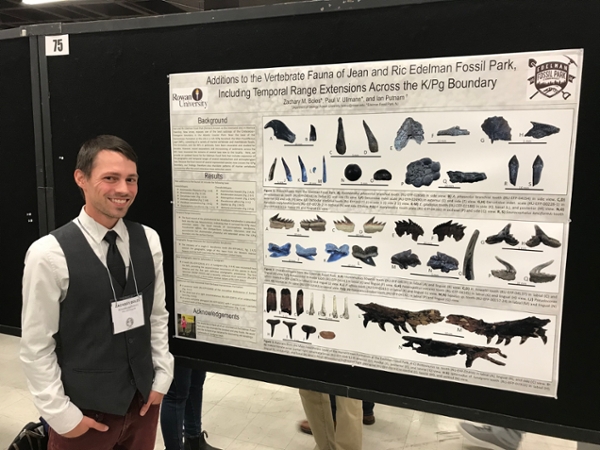

Newly published Rowan University research confirms that some sharks and other fish, which were thought to have existed only off the West Coast or off Europe, also lived along the Atlantic coastline.

April 15, 2024

"The History of Now," a course taught this academic year, focuses on Rowan University's proud, 100-year history.

April 15, 2024

Amid the celebration of Rowan University’s centennial, this year’s Commencement Week promises to be bigger and more exciting than ever!

April 12, 2024

Physician, educator and researcher, Richard Jermyn, D.O., assumes permanent role following tenure as interim dean.

April 12, 2024

Rowan University, the fourth fastest-growing public research institution in the nation, and Taylor & Francis, a leading international publisher, have announced a new, three-year Read & Publish Agreement.

April 12, 2024

In total, Rowan received more than $800,000 in new awards from NJHF, which supports research, community health and social service programs at New Jersey institutions each year.

April 11, 2024

Rowan University is among the top 10 National Institutes of Health (NIH)-funded institutions in New Jersey for fiscal year 2023.